Save big when sending E-Cards to friends and Family

Moving funds shouldn’t cost an arm and a leg, so we designed CuminPay to save you time and money when you send and receive.

Get approved for a CuminPay Card today.

CuminMall Membership is included with your E-Card.

Our competitive fees

What is an E-Card?

How to use an E-Card?

How to use an E-Card?

A quicker way to shop & spend online in 3 easy steps

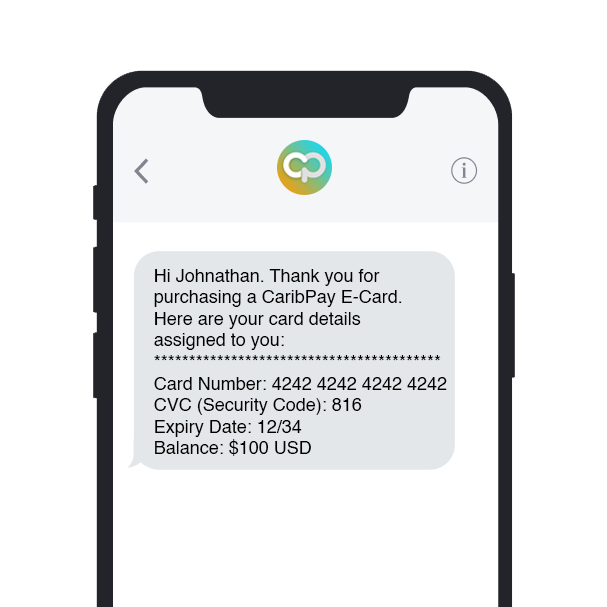

Step 1:

We will send you a secure SMS to your phone number with your card information

Step 2:

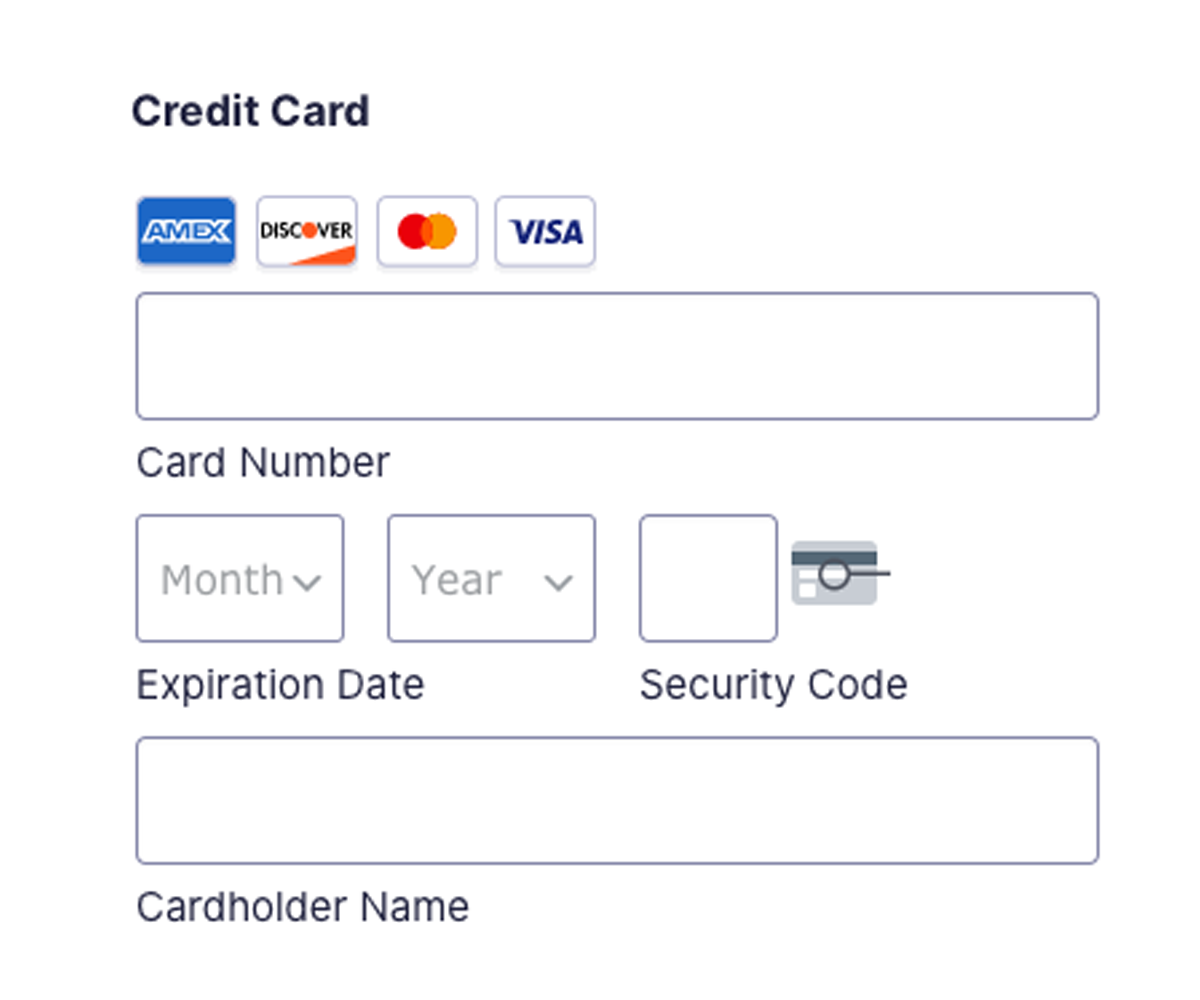

When on the checkout page while buying online, copy and paste your card details

Step 3:

When your card balance is close to empty, put more funds on it.

Why get an E-Card?

Use it to get a Netflix subscription, shop on Amazon & more!

We do NOT ask for 2 pieces of ID (Unlike your bank)

Great way to send funds to family overseas

Get your E-Card within 24 hours

Financial inclusion, at a low price

For individuals without a bank account and debit card, accessing financial services can be a challenge. However, with the advent of E-Cards starting at just $5, financial inclusion has become more attainable than ever before.

For individuals without a bank account and debit card, accessing financial services can be a challenge. However, with the advent of E-Cards starting at just $5, financial inclusion has become more attainable than ever before.

An Affordable way to shop online

You can get a CuminPay™ E-Card starting at the FULL value of the card PLUS $5 USD. Here is a breakdown of different E-Card amounts and the one-time activation fee.

$50 USD Balance E-Card

• You pay $55.00 USD

• You get a $50.00 USD E-Card

$100 USD Balance E-Card

• You pay $110.00 USD

• You get a $100.00 USD E-Card

$250 USD Balance E-Card

• You pay $270.00 USD

• You get a $250.00 USD E-Card

$500 USD Balance E-Card

• You pay $535.00 USD

• You get a $500.00 USD E-Card

$1000 USD Balance E-Card

• You pay $1060.00 USD

• You get a $1000.00 USD E-Card

Get your card easily

1. Select what amount to put on your card

2. Get a text message with your card details

3. Spend money using your new card

Makes for a great gift for your family!

Frequently Asked Questions

CuminPay E-Cards are Virtual Debit Cards issued to our customers. You can add these cards to your phone to pay for groceries or meals restaurants, in addition to shopping online.

There are no additional fees.

CuminPay creates a US Checking Account with every card, so your friends and family can send funds to your card.

CuminPay uses industry-standard security measures to protect users’ personal and financial information.

How to use an E-Card?

How to use an E-Card?